What is a Cache?

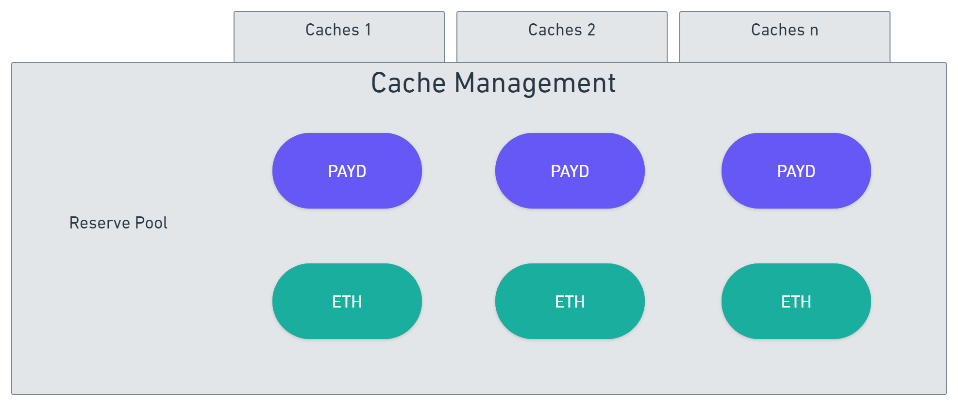

staked.finance is a collateralized stablecoin issuance platform. Users can stake ETH as collateral in a smart contract ("Reserve Pool") and issue stablecoin tokens (PAYD). The PAYD can be transferred to their own Ethereum wallet address or to the rewards pool. Once in their wallet, users can freely transfer PAYD tokens to any other Ethereum address. Each individual collateralized position is called a Cache. To unstake your ETH, you will need to return PAYD to the platform by managing your cache.

Where does the ETH go?

Majority of these ETH will be locked in ETH2 staking validators (“Validator Pool”) and ETH2 mining on Ethereum Virtual Machine (EVM) to earn Staking Rewards and Mining Rewards. The rewards are then paid out to users who stake PAYD into the rewards pool. Learn more about ETH Liquidity Management.

How can my Cache position change?

Liquidation Events

The Individual Reserve Ratio (IRR) monitors the value of the ETH over the existing PAYD issued to determine how safe a Cache position is.

staked.finance uses the Chainlink oracle (Tellor as backup) which updates the ETH: USD price every 3 hours and whenever the price changes by more than 0.5%.

Liquidations occur when the value of the ETH collateral falls

- Normal Mode: When Individual Reserve Ratio (IRR) is below the Minimum Reserve Ratio (MRR) of 115%

- Recovery Mode (potentially triggered by a sharp drop in ETH price): Individual Reserve Ratio (IRR) is below 155% when Total Reserve Ratio (TRR) is below 155%.

Affected caches positions will be closed upon liquidations. ETH collateral of closed caches (minus liquidation fees) will be distributed to rewards pool users, in exchange, the rewards pool users will have their staked PAYD proportionally burned to maintain the stability of PAYD.

Issued PAYD does not have to be returned to the platform in the case of a liquidation event.

Your cache positions can change when other users perform the following actions:

Swap

ETH to PAYD

Every healthy cache receives more ETH and has more PAYD issued proportionally.

PAYD to ETH

Every healthy cache has reduced PAYD issued and less ETH staked proportionally.

Liquidations

Where Rewards Pool PAYD is insufficient to absorb Liquidated PAYD issued

Every healthy cache receives more ETH and has more PAYD issued proportionally.

Recovery mode liquidations where IRR <= 100%

Every healthy cache receives more ETH and has more PAYD issued proportionally.

Where 100 < IRR < 115% and where Rewards Pool PAYD is insufficient to absorb Liquidated PAYD Issued Debt.

Every healthy cache receives more ETH and has more PAYD issued proportionally.

staked.finance (SF1) is in the midst of a applying for a DPT licence with the Monetary Authority of Singapore. Please note that during this period, our website may change and be refined over time.